We are living through a rapidly changing healthcare environment. Our population is aging, and more people are developing chronic health conditions like diabetes and hypertension. Patient behaviors are evolving—smoking is on the decline, but electronic cigarette usage is rising. Innovations in treatment are changing the way people access care and what types of care patients receive. The combination of these changes increase healthcare costs, but the costs are not evenly distributed across the population—Luo, Stone, Sakaguchi, et al. found that the sickest 5% of the population make up 50% of healthcare costs.

These complex patients are at higher risk of negative health outcomes, unnecessary or preventable hospital utilization, and increased financial burden on the nation’s healthcare system. Identifying and managing these patients is critical for improving population health and succeeding in value-based contracts. With interventions tailored toward the individual, practices can now match available resources to patient needs, improving the quality and reducing the cost of care.

But how can organizations effectively determine which patients in their population are at greatest risk and how to manage their conditions? Identifying these patients can be overwhelming and time-consuming—manual patient chart audits aren't fun whether you have 30, 300, or 3,000 patients. Azara tools allow users to stratify their population’s risk level in a few different ways to help simplify this process.

Azara Risk Algorithm

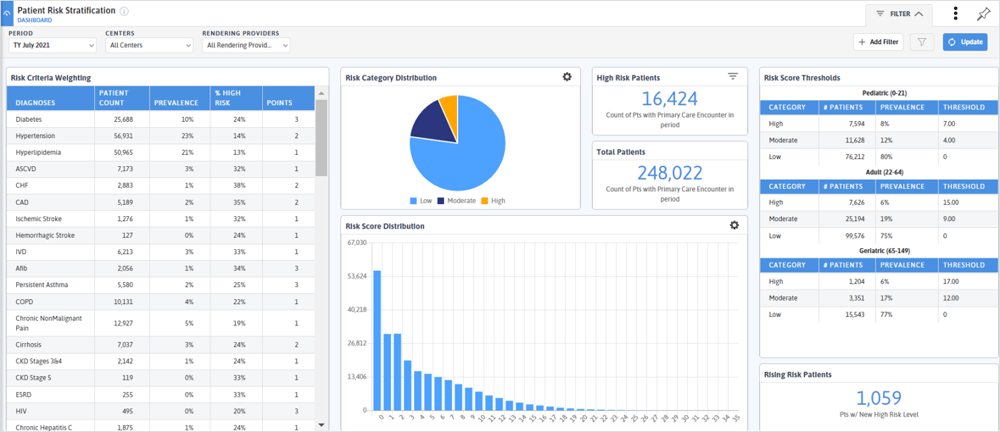

Azara’s risk algorithm uses patient diagnoses, disease severity, social determinants of health (SDOH), medications from the EHR, and utilization data to stratify your population into low, moderate, and high-risk categories. This stratification most closely resembles the American Academy of Family Physicians risk methodology with the benefit of automatically being calculated across the entire population. When the Azara risk algorithm is implemented, an organization is able to determine the criteria and weightings to best suit the needs of their unique patient population. Once a practice has the risk algorithm, they can use it across DRVS to identify high-risk patients using the Risk filter and understand the distribution of risk with the Patient Risk Stratification dashboard. For practices looking to become NCQA PCMH recognized, the Azara risk algorithm satisfies the Care Management and Support CM 01 criteria.

The Azara risk algorithm is the most popular methodology across DRVS users today, with approximately two thirds of DRVS practices employing our risk stratification. Other organizations utilize the Johns Hopkins University Adjusted Clinical Groups (ACG) model. This algorithm uses inpatient and outpatient diagnoses from the EHR (and claims, if available) to determine risk and predict hospital utilization. Their proprietary logic is loaded into DRVS to determine patient risk.

Risk Adjustment Factors

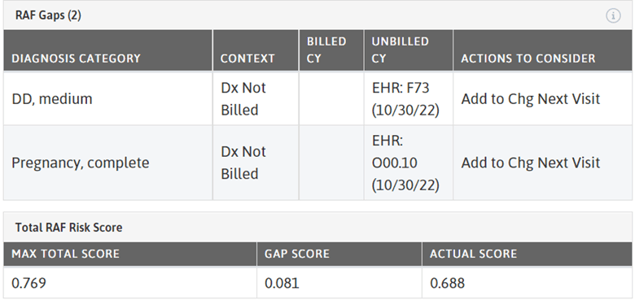

Risk is foundational to success in value-based contracts. Understanding the risk level of your population (and appropriately coding that risk) allows for the allocation and distribution of appropriate resources to help manage this population. Risk adjustment is a statistical process that considers the underlying health status and health spending of patients when examining their healthcare outcomes or healthcare costs. There are several types of risk adjustment models used to risk-adjust healthcare data. Risk Adjustment Factors (RAFs) are the individual factors that make up a type of risk score that affect how providers are reimbursed. For each patient, the RAFs are added up for a total score—a higher score indicates a more complex patient and thus a higher reimbursement from the payer. A RAF gap is when a code has been billed in the past, but not the current year.

In DRVS, there are two types of RAF calculations available: HCC Medicare and the Chronic Disability Payment System. The Centers for Medicare and Medicaid Services Hierarchical Condition Category (HCC) model focuses on long-term conditions like diabetes, COPD, and CHF that impact the likelihood of future healthcare costs and focuses more on older adult population. The Chronic Disability Payment System (CDPS) is a diagnostic classification system that Medicaid programs, mostly children and younger adults, can use to make health-based capitated payments for Medicaid beneficiaries. RAFs (and RAF gaps) provide information to the provider that can assist them in appropriately coding the patient visit, leading to a more accurate representation of risk for payer reimbursement. Accurate coding is especially important for practices engaged in value-based contracts; if plans have better insight into the acuity and complexity of the patients they serve, practices can receive appropriate compensation to support their populations.

In DRVS, Azara presents Risk Adjustment Factor gaps as “actions to consider” with the following options: (a) Evaluate unbilled codes or (b) Add to charge to the next visit. Coding recommendations are suggestions and must be recorded by the provider, as all diagnosis codes require clinical judgement before billing. Just because a code was captured in the previous year does not mean it still applies to the patient. At the point of care, providers can view RAF gap recommendations using the Patient Visit Planning Report (PVP), the Care Management Passport (CMP), or the EHR Plug In. The PVP provides a summary of the RAF Gap diagnosis categories, while the CMP and Plug In add context to the gaps and actions to consider.

With our evolving healthcare landscape and transition toward value-based care, it is increasingly important that practices can accurately identify high-risk patients. Identification can help lead to improved management of the riskiest of patients (leading to potential cost savings) and accurate billing (leading to appropriate reimbursement rates).

If you are using Azara Risk stratification or RAF reporting to manage your patient population, we would love to hear from you here.

Related Articles

Keeping Care Close to Home: How Azara Empowers Rural Providers

Explore Insights

From Silos to Solutions: Advancing Behavioral Health Integration in Primary Care

Explore Insights